The long and the short of it

Each trader has a distinct trading style. It’s as individual as your fingerprint or your DNA. Visualizing your style can help you see where you ‘naturally’ trade better, and where you’re more vulnerable.

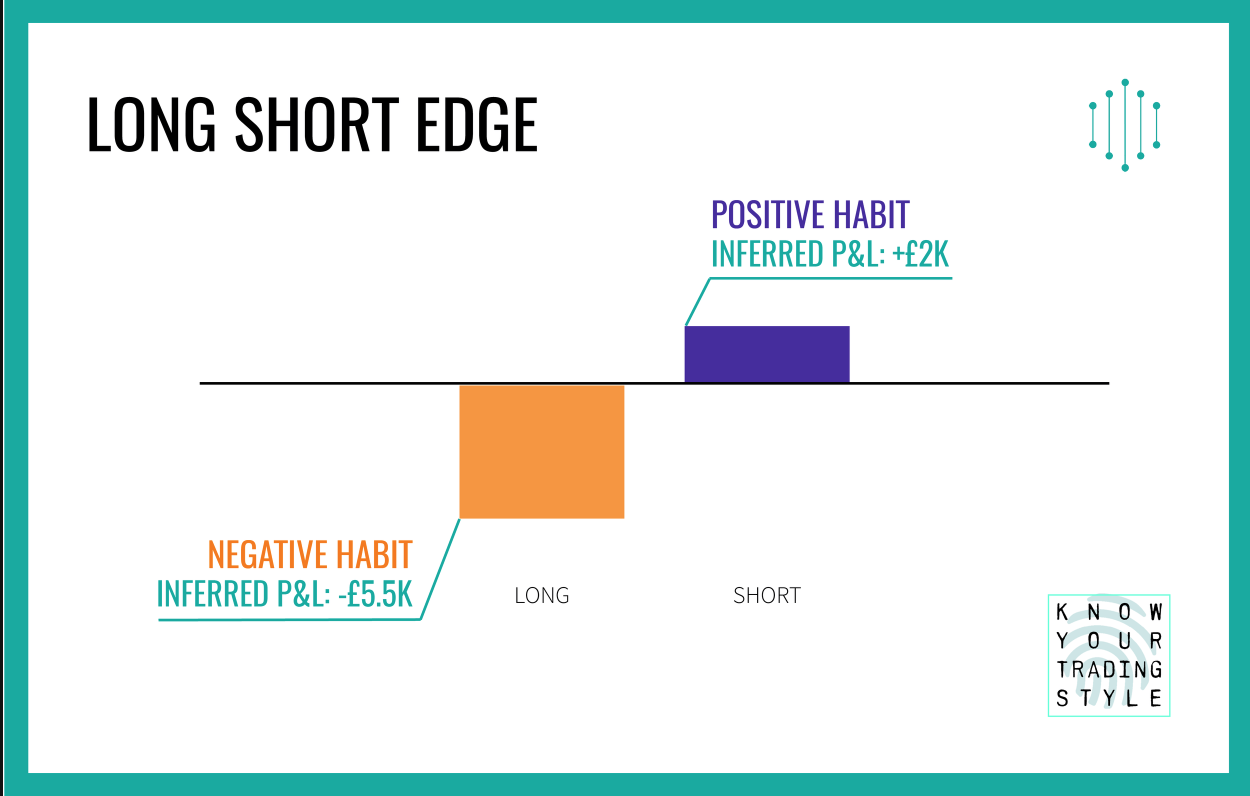

YOUR LONG SHORT EDGE

Many traders trade more successfully with either Long or Short trades. It’s important to know whether you’re more of a Long or a Short trader, and what effect it’s having on your bottom line.

Take Ted’s Long Short Edge for example.

Ted's Long trading shows a negative habit. The Inferred P&L shows us that if this behaviour was the norm, Ted would have lost £5.5k. But when he trades Short, Ted is more disciplined and more successful. If this positive habit was the norm, Ted would have made nearly £2k.

There are many different reasons why you could be better long or short, and it's important not to discount any of them.

For example, if you only review trades executed in a bear market, it might appear that you are a better short trader, while really it's a reflection of the market direction.

Similarly, in low volatile markets, long trades may move very slowly. You may not have the patience to wait for your targets, and may cut your losers too quickly.

In this case, Ted was actually using a very different set of Targets and Stop Losses for his short trading, than for his long trading, and it was working better for him.

To recap, there are three steps to managing your Long Short Edge:

- Step 1 is knowing if there is a real edge

- Step 2 is determining the cause

- Step 3 is to adjust and correct