The Trading Guide Part 5-Setting a Safe Position Size

If you are new to trading, there are a few simple rules you can follow that will greatly increase the likelihood of surviving and succeeding.

1. Our first rule is that your daily loss limit should be set at 5% of your account balance.

2. Our second rule is that you should stop trading for the day after losing 3 times in a row.

3. Our third rule is that you should have a maximum of 3 open trades at any one time.

4. Our fourth rule is about setting win and loss guardrails for individual trades.

Our fifth rule is that you should set a safe position size.

Your position size is important because if it’s is too big or too small, you'll either take on too much or too little risk. You’ll either stop trades too quickly or let them run too long.

You need to determine the right balance for each trade.

How do you do this?

First, decide how much you want to risk on the trade. This should be consistent throughout all your trades, and should be below 1% of your account balance.

Then decide your exit prices-when you will close the trade if you are winning, and when you will close the trade if you are losing.

Then calculate your position size.

Say you have €10,000 in your account and you want to risk 1% (€100) going long on product X, which is currently priced at €10. You would like to make €120 on a winner. Here are some scenarios with a loss level of €100.

You buy 100 shares, setting your stop loss to €9. If price falls to €9 you sell. The Profit & Loss, or P&L is -€100. If price rises to €11.20 you sell. P&L then is €120.

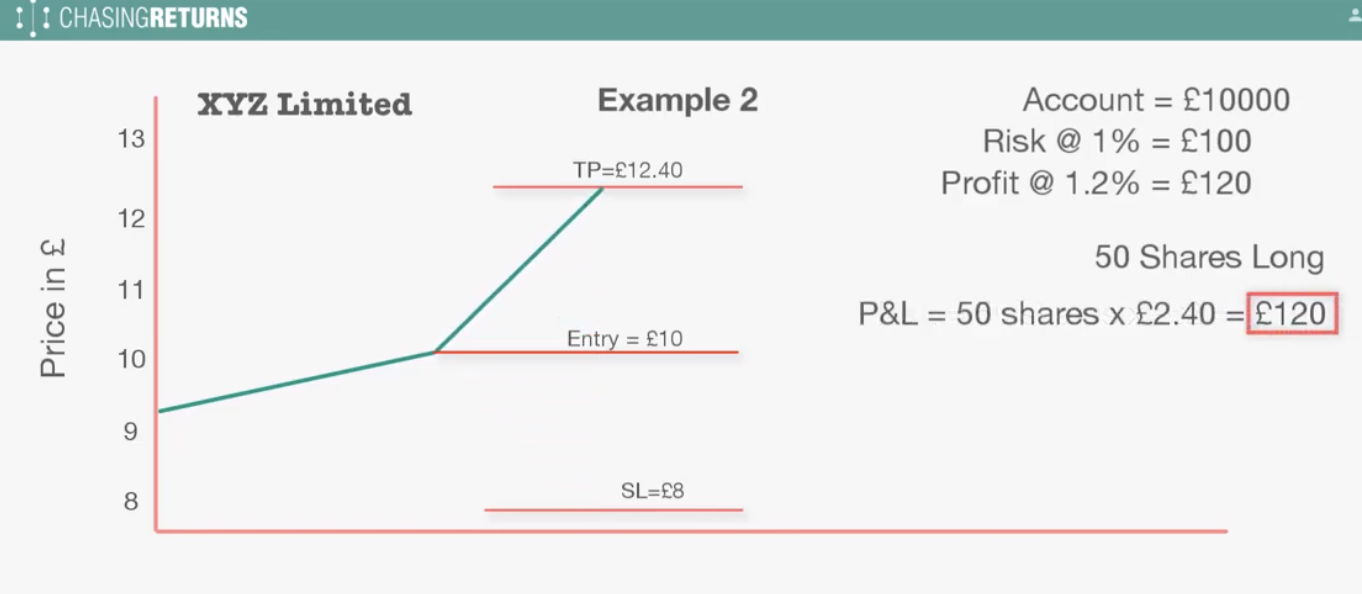

You buy 50 shares setting your stop loss to €8. If price falls to £8 you sell. P&L is -€100. If price rises to €12.40 you sell. P&L then is €120.

In the first scenario, the price only has to rise by €1.20 to make your target profit, but if it drops by €1 you have to close the trade.

In the second example, the price has to rise by €2.40 to make your target profit but it can drop up to €2 and not force you to close the trade, thereby giving the trade more room to run.

You should calculate your position size for each new trade, as it will not be the same for all trades due to inherent volatility, the way each asset is priced, and your own risk appetite for the trade you are planning.

For example, let’s look at EUR/USD versus Bitcoin for comparison.

EURO/USD ON THE LEFT, BITCOIN ON THE RIGHT

We may decide for EUR/USD that price will not rise more than 0.67 of a cent, but could fall 0.8 of a cent.

For EUR/USD, a move of 0.0001 equates to $10 for a position size of 1, so if we had a size of 1 on this trade we could lose $670.

To risk $100 we would need a position size of 0.15.

Let’s compare this to Bitcoin on a chart on the same timeframe.

We may decide for Bitcoin that the price will not rise more than $183 but could fall $219.

For Bitcoin a move of $1, on a position size of 1, equates to $1, so with a position size of 1 on this trade we could lose $183.

To risk $100 we would need a position size of 0.55.

Therefore, we have 2 trades with a loss level of £100, one has a position size of 0.15 and the other has a position size of 0.55.

Make sure you understand how your trading platform represents size to ensure you risk the amount you expect on each trade. Proper position sizing is key - risk too little and your account won't grow; risk too much and your account can be depleted in a hurry.

To recap:

1. Decide your risk level on each trade.

2. Decide how much you are willing to lose on the trade.

3. Calculate the position size on each trade.