Losing streaks happen (more often than you think)

A run of losses can really throw you off your game. Here is an example showing how expected returns can change depending on where you are in a run of losses.

For every 100 trades, you should know the likelihood of a losing streak, for 2 great reasons.

(1) It gives you a heads up on your risk per trade. Most traders blow up due to too much leverage. If you know the likelihood of a string of losers, you can plan your risk management strategy accordingly.

(2) The impact on self-esteem. We know that we make different decisions when thinking about losses, instead of thinking about profits. These can impact your returns.

Here are some simple facts you need to know your Win Rate (percentage of your trades that are winners).

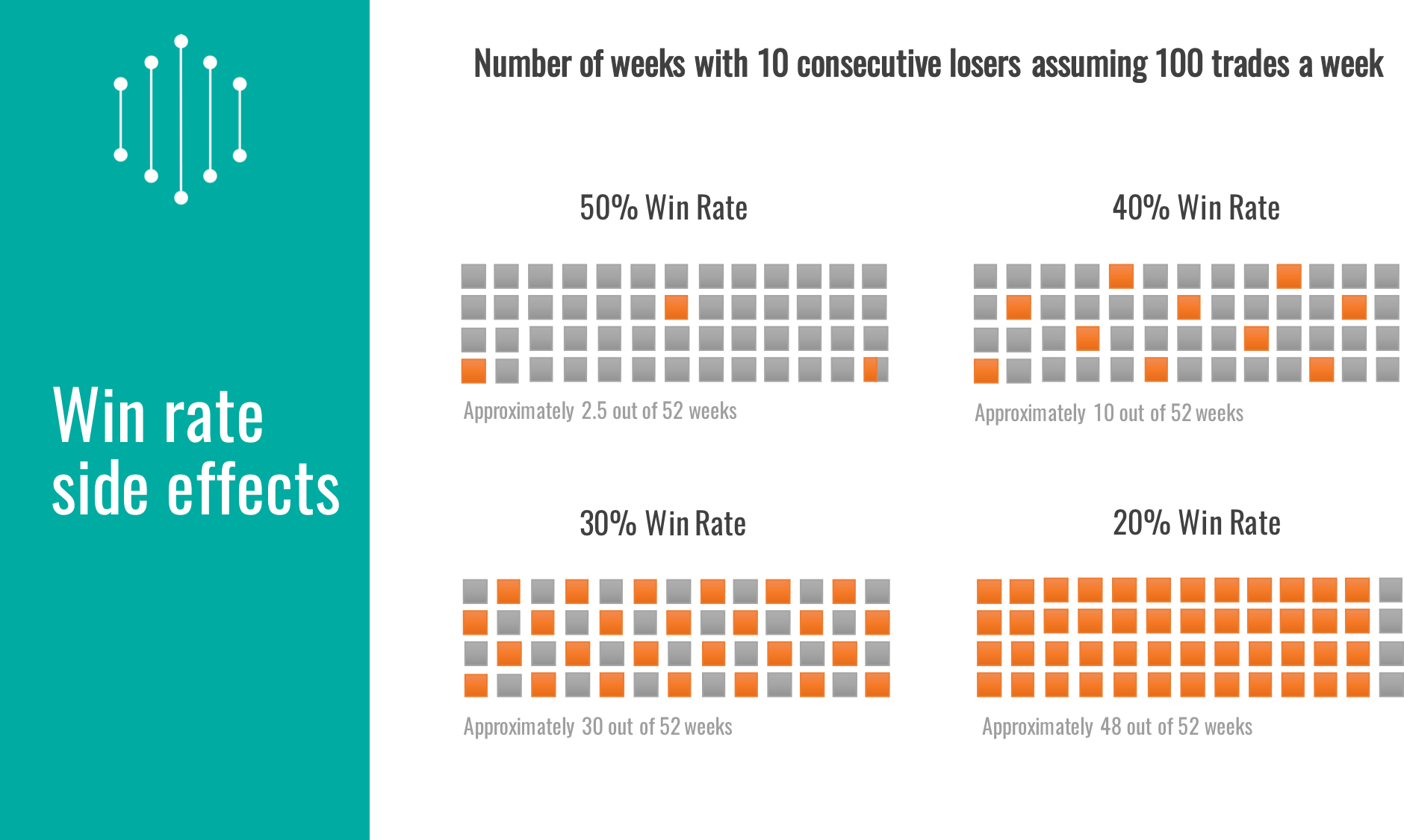

Let's assume you trade 100 trades per week.

If your win rate is 50%, you will have a losing streak of 10 between 2 and 3 times per year.

With a win rate of 40%, you can expect this to increase to 10 times per year

If it's 30%, more than every second week will have a losing streak of 10 on average and finally if you have a very low win rate of 20% you will have a losing streak of 10 most weeks.

Know your win rate. Factor it into your money management. Losing streaks WILL happen, so make sure your money management can sustain them.

Expect the unexpected, and plan for it.