How Your Emotions Impacts Your Trading

As much as we like to think of ourselves as logical and rational when we make decisions, our emotional state is a big driver in our behaviour. Emotions influence decision making, both for better and for worse. Here we explore two strains of emotions- anticipated, and immediate, and their impact on trading.

Anticipated emotions are what we imagine feeling as a consequence of a decision. Imagine you just closed a winning trade, and now are anticipating regenerating the feeling of excitement by quickly putting on another trade. You might want to put on a big trade because you’re watching the markets move, and you have a fear of missing out on a good opportunity. These emotions are not actually felt during the decision, but are anticipated so taken into account.

By contrast, immediate emotions are what we feel in the moment, and can be influenced by outside parameters. We might be feeling angry because our laptop crashed, or irritable because we skipped lunch. These emotions have nothing to do with your trading plan, but they can impact it greatly by causing us to make impulsive decisions that we hadn’t planned to. Immediate emotions impact your trading choices more directly-they can change and cause you to make choices they wouldn’t usually make logically. Yet, they are the ones we are most blind too. We don’t realise how outside factors impact our behaviour.

Trading generates intense feelings for traders, whether they are winning or losing. Emotions can greatly impact how a trader makes decisions. Problems arises when certain emotions cause destructive and detrimental trading behaviour. It is less important whether the emotion is immediate or anticipated, and instead we should be focusing on identifying the specific emotion and understanding it’s effect on your trading. Much has been said about fear and greed in trading, but there are other emotions that have equally negative effects. In this blog, we will look at happiness, fear, anger, sadness and greed.

Happiness

When we are in a good mood it signifies an absence of danger and thus we don’t feel the need to think critically. We can make rash, ill thought out decisions when we are in a good mood. This is because when we are happy, we’re more likely to think about our potential gains and by thinking about them we also believe they are more likely to happen (this is called the saliency bias). Being in a happy mood also means we’re more likely to perceive ambiguous information (such as a market signal) as a positive sign, are so are more optimistic about our risk.

We may put on a large, undisciplined trade after having a winning streak and then put it down to bad luck if we have a big loss. We don’t learn from our bad behaviour and are overconfident of our abilities. This means we don’t improve-even if we review our trading actions, we find it hard to acknowledge our mistakes when we are happy, so we won’t make the progress and improvements we need to become an expert trader.

Anger

Anger has the opposite effect. Trading when angry means traders take big risks, and often blow up their accounts quickly. These high-risk situations can become self-defeating. The more we lose, the more angry we’re likely to feel (at both ourselves and the market). We then make even more destructive decisions in that anger. Revenge trading is the easiest way to blow up your account.

Fear

Fear has a different impact. It causes us to actively avoid making decisions, and to be overly risk averse. A trader who is feeling fearful may play it too safe, and close winners earlier and sit on their account, not doing anything. We might also fail to close a losing trade, instead avoiding the decision and leaving the trade to potentially turn into a bigger loss. We may decide not to enter a well thought out trade.

Fear of losses makes people stick to the status quo. It can make us put off things that are in our interests to do. Heuristics, such as sticking to the status quo, are habit forming, and so can be a barrier to changing behaviour, even when there is a good reason to change. Traders who feel fear, whether directly from imagining a loss or from an external force like watching a horror film, have tendencies towards inertia.

Sadness

By contrast, if we are feeling sad, we are more risk averse, and we also set our expectations lower. During trading days where we are feeling sad, we will aim for much less than you usually would. We will be more likely to close your trade early and not let it reach it’s true potential. We’re more likely to be overly prudent in our trade size, and so miss out on making money.

Greed

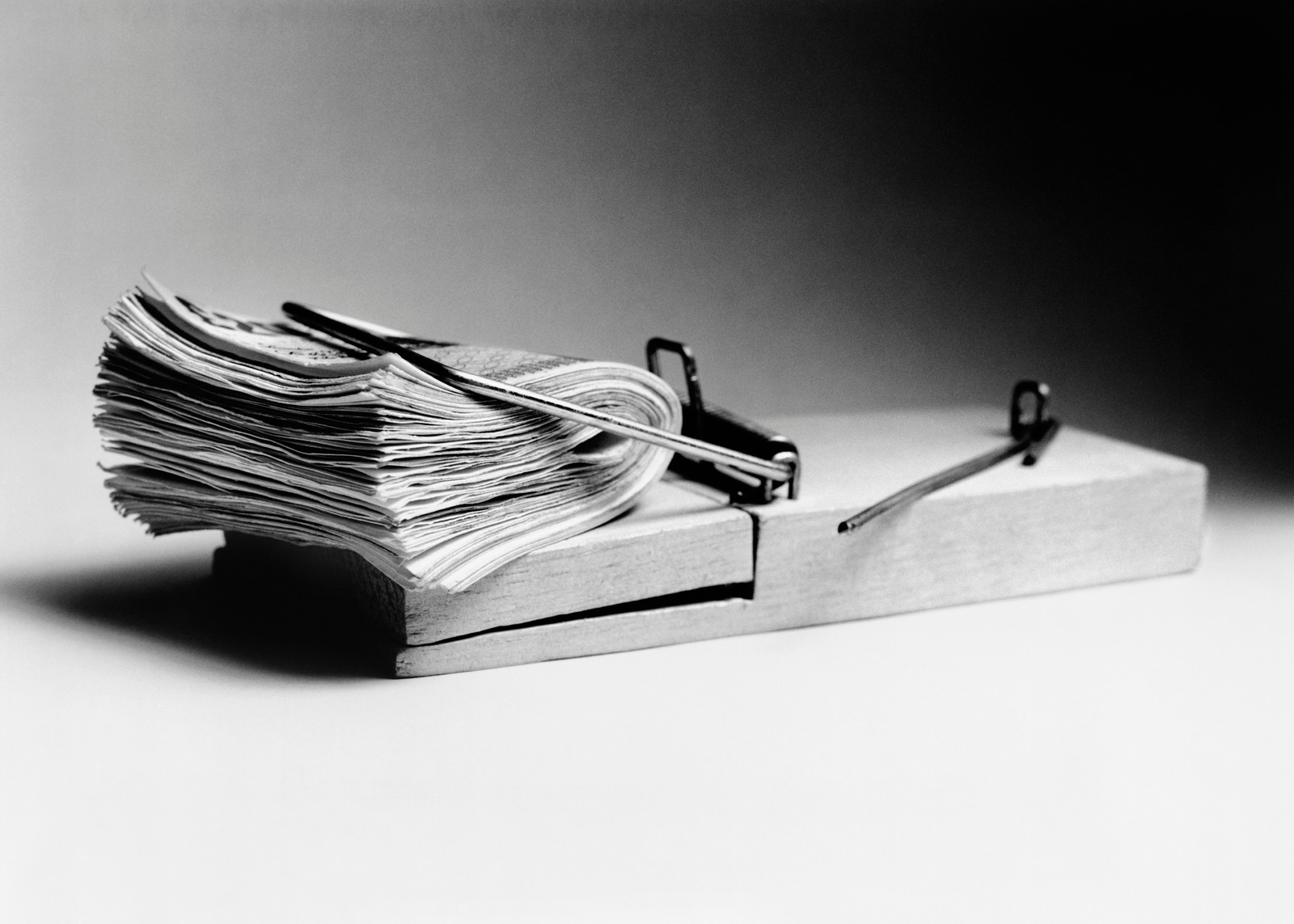

Greed is another emotion that can have negative effects on our trading decisions. We know about greed contributing to the dot com bubble and crash, as well as Bitcoins rapid rise and crash. People bought stocks and had quick wins, so bought more and more hoping to replicate more quick wins, thus inflating the value greatly. People act greedily when theexpected reward far exceeds the expected time and cost to be invested. They want easy wins. Trading while feeling greedy can cause us to ignore targets, stops, and other parts of our trading plan. We become overconfident which can also cause sloppy trading and end in massive losses.

In summary, the resulting action for each emotion is:

· Happiness – underestimate the risks

· Fear – we fail to act (inertia)

· Anger – Overreact (Revenge)

· Sadness-risk averse

· Greed – Take bigger risks

All these actions result in traders not sticking around in trading. We can’t solve this by avoiding emotions. They’re an unavoidable part of the trading experience. So what can we do?

We recommend a 3 step system: Identify-Pause -Unlearn

Identify

Before each trading session, ask yourself how you are feeling. Then decide how much you are feeling that emotion, from a scale of 1(barely) to 5 (intensely). Use the Geneva Emotion Wheel to help you.

Pause

When you are experiencing intense emotions,avoid making any major decisions. Hit pause on what you are doing. Take a break, and come back to your trading later when you’re more neutral. If you have to trade, reduce your trade size so you are reducing the emotional effect of those trades.

Unlearn

The hardest step is trying to unlearn your instinctive behaviour when emotional. It’s not impossible though. Hold yourself accountable. Have a trading plan, and review at the end of every trading day whether you stuck to your plan or not. It is particularly important to be in a stable emotional state when you do your post trade analysis, so that you can give yourself the best chance of being realistic about your days trades.

You will make trades based in emotion, but a second revisit to each trade, when you are not actively trading (preferably on the day you completed the trades), can help you catch them, and learn not to repeat that behaviour. Simply being aware of your emotions can be the first step to diffusing them, and improving your decision-making skills. When you know how you’re feeling and you understand how those feelings influence the way you view risk, you’ll be better equipped to make a sound decision.