Why 5 is the magic number

Do you know how the number of products you trade impacts your returns?

Chasing Returns clients are changing their behaviour based on a deep understanding of their strengths and weaknesses. There are many common traits among traders that everyone should be aware of, as it can help you improve your own trading.

In the first of our series about exploring your trading edges, we look at the number of products a trader trades, and how this impacts profitability.

Traders, especially beginner traders, often feel a change in product or adding more products might give better results. In fact the opposite is the case.

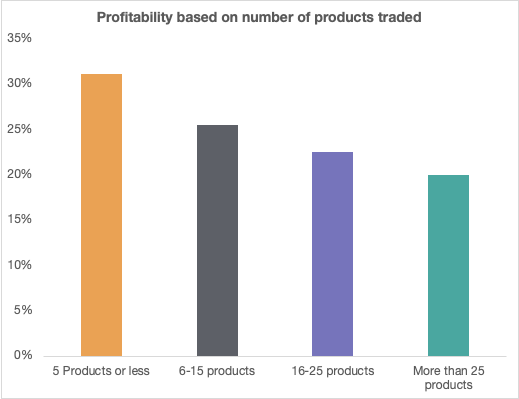

Traders who stick to 5 products or less do a lot better than those who trade more products. In fact our studies show that traders who stick to 5 products or less are over 50% more likely to be profitable compared to those with over 25 products

Why? Because by sticking to a few products, you will be more likely to get more familiar with those products trading patterns, and be more in tune with these markets. Our brains are hardwired to only process a select amount of information, and once we overload on that, in this case by trading too many products, we end up making much poorer decisions in all aspects of our trading. This is known in behavioural science as choice overload; once you get to 7 (+/- 2) choices, your brain stops making optimum decisions because it’s overloaded by the choice available. For trading and its complexity 5 is the magic number.

How many products are you trading in right now? Check now here.

Here we can see that winning traders who stick to 5 products or less generate trading returns of 26% compared to 19% when they are trading more than 25 products.

Similarly, reducing the number of products for losing traders is also beneficial. If you are a losing trader, you can reduce your losses if you reduce the amount of products you are trading to 5 or less. This is a particularly important for beginners, in the first 50 trades new traders can reduce their losses from -23% to -17% thereby preserving their trading capital while they build up their trading experience.

If trading less than 5 products is ideal, then how do you settle on the right products to choose? There is no one answer to this. Each traders personality is different, and it’s good to try a few different products to learn which types suit you best.

You may be someone who gets bored or frustrated if you are trading something with very low volatility, but thrive when there is a lot of movement in the market.

Or you may be completely the opposite, and get stressed when there is too much market movement causing you to overwrite your exit plans and take heavy losses, or stop a trade too soon out of fear.

It is good to experiment a bit, without trading too many instruments. The key point is to keep your risk sizes small until you build up a trade history, and can learn to understand your expected returns, strengths and weaknesses. This does not happen overnight, and to rush your trading journey can cause you to blow up your account.

If you are not as successful as you would like, or if you are not yet sure what your best products are , try to stick to 5 products or less. Keep your position sizes small until you build up enough history to understand your unique patterns of behaviour.

Now that you know how many products you should be trading, the next blog in our series will look at your most traded product and what you can learn from this.